Work Opportunity Tax Credit (WOTC): Eligibility and 8 Key Tactics to Claim and Minimize Workload

March 9th, 2022

In 2022, many employers are hiring at higher rates to grow their teams and fill in gaps from labor shortages. During peak hiring season, employers should be thinking about the Work Opportunity Tax Credit (WOTC). MP’s tax experts will outline who is entitled to compensation from the WOTC program, how to claim this federal income tax credit, and how to reduce the workload on the claims process.

What is the Work Opportunity Tax Credit (WOTC) program?

The WOTC program, approved through the end of December 2025, gives employers a tax incentive for hiring individuals from a WOTC targeted group. These groups include job seekers whom the Department of Labor has identified as facing barriers to employment. To trigger eligibility for a WOTC claim, new hires must fall into at least one of the targeted groups.

WOTC Targeted Groups:

- A recipient of the Supplemental Nutrition Assistance Program (SNAP)

- A member of a family who has received TANF (Temporary Assistance for Needy Families)

- Qualified veterans

- Ex-felons

- Residents of rural renewal counties or empowerment zones

- Vocational rehabilitation referrals

- A Supplemental Security Income (SSI) recipient

- People who have been unemployed long-term

Note that some employees will fall into multiple groups, and thus the WOTC credit they qualify for will be higher. The highest possible WOTC is $9,600. This amount is for a disabled veteran (with a service-connected disability) who has been unemployed for six months or more.

8 Key Tips for Claiming a WOTC

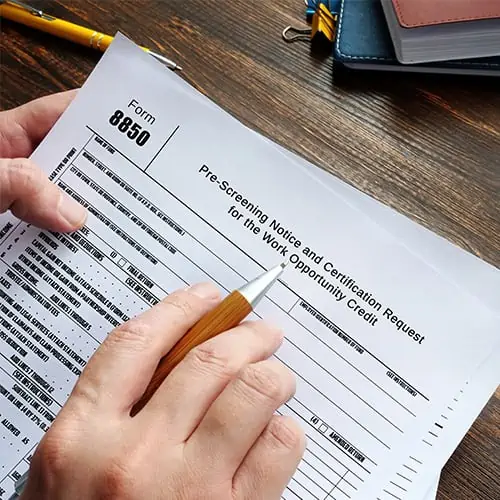

- Obtain certification that an employee is a qualified member of one or more of the required groups. Employers must file an IRS Form 8850 with their state workforce agency. They may be asked to submit supporting documentation.

- Employers must file their Form 8850 within 28 days of the worker’s start date.

- The employer should claim the WOTC as a general business credit on Form 3800 against their income taxes. This will require completion of:

- Form 5884

- Related income tax return and instructions (i.e., Forms 1040 or 1040-SR, 1041, 1120, etc.)

- Employers must note that credit will be limited to the amount they owe in business income tax liability or Social Security tax.

- Tax-exempt organizations must claim their WOTC on Form 5884-C. They claim the credit against Social Security taxes owed. (This won’t affect their Social Security tax liability as reported on their employment tax return.) The credit is limited to the employer Social Security tax owed on wages paid to all employees during the time period the credit is claimed.

- All employers (taxable and nontaxable) must wait to claim their WOTC. This credit is based on qualified wages paid and the number of hours worked during the first year of employment.

- Employers may claim:

- Up to 25% of qualified first-year wages for 120 to 400 hours worked

- Up to 40% after the employee has worked 400 hours

- Organizations should consider utilizing a screening form during the onboarding process. This form should allow new hires to voluntarily identify as a member of a WOTC-eligible group. This practice allows employers to note which employees they should prepare to file an IRS Form 8850 within their first 28 days of their start date.

How can organizations minimize the workload in claiming Work Opportunity Tax Credits?

Some HR and payroll companies, such as MP, assist in the process of claiming a WOTC. Firstly, MP offers Applicant Tracking Software and onboarding technology that helps employees flag candidates and new hires eligible for WOTCs. MP can advise employers how to obtain any required documentation for WOTC certification from the state workforce agency. Using payroll software, data, and tax expertise, organizations such as MP calculate the maximum WOTC for a qualified worker and assist with preparing and submitting forms for certification. These companies then help employers claim their WOTC against taxes owed. When employers work with payroll and tax experts to claim their WOTC, they are able to avoid the complicated paperwork and calculations required to complete the claims process. Tax experts, such as those at MP, often help employers claim the maximum WOTC, finding funds they wouldn’t have identified on their own. They ensure the credits are claimed for every applicable target group.

Interested in claiming your own WOTC? Check out MP’s WOTC Services.

Recent Posts

- Part 2: Compliance Landmines for Employers — How to Avoid Costly Mistakes Under the BIG, Beautiful Bill

- Breaking Down the BIG, Beautiful Bill: What Employers Need to Know Now

- New “Junk Fee” Law: What Restaurants and Employers Need to Know

- What Dedicated HCM Support Teams Actually Do

- Why We Choose isolved, Not Just Any Platform: The Smart Way Independent HCM Providers Select Technology

Categories

- ACA (10)

- AI (6)

- BizFeed (6)

- Business Strategy (119)

- COBRA (5)

- Compliance (240)

- COVID-19 (92)

- Diversity (12)

- eBooks (19)

- Employee Engagement (33)

- Employee Handbooks (24)

- ERTC (29)

- FFCRA (7)

- HR (308)

- MP Insider (13)

- Payroll (161)

- PFML (9)

- PPP (24)

- PTO (5)

- Recruiting (54)

- Remote Work (39)

- Return to Work (32)

- Unemployment (1)

- Wellness (22)

Archives

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- January 2023

- December 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020